Post updated on 6.13.2020 to answer Qs as to whether an employer can collect the SSS SBWS (Small Business Wage Subsidy) aid that was wrongly given to employee.

This blog post is in response to a situation when HR indicated a wrong salary in a contract and the error was discovered after the employee signed the contract. Below is the situation in context:

hi sir! may i ask some help with this matter? i really need some advice.

kahapon po, nakatanggap yung supervisor ko ng tawag galing sa mechanic namin. tinatanong nya kung magkano na daw ba ang starting ng mechanic samin ngayon. may dalawa kasing bagong hired na mas mataas yung sahod kesa sa kanya.

then upon checking, ang nailagay ngang rate dun sa mga bagong mechanic ay rate para sa trailer driver which is much higher sa tamang rate ng mechanic. yung mechanic na tumawag eh 2yrs na sa company.

pano po kaya ang tamang way rito. TIA!

In a given situation, what should HR do?

The author who gave the most sound advise with legal basis, generously agreed to expound his answer and wrote this blog post – ASKSonnie, Ed

When the HR- Compensation and Benefits makes a mistake in giving out the intended salary and the employee already received it in his last 2 pay period, “Patay”- will be the HR CompenBen’s Reaction. Don’t worry there’s still a remedy.

There was this intance when my boss called my attention and asked me, “Ely, the salary of Employee X that he is currently receiving is not the same salary that I negotiated with him, there’s a big difference, mababawi pa ba natin yun?”

Being the HR Head, I didn’t want to advise the President that it’s a done deal boss and that’s it. I calmly advised him, that we can still correct it, don’t worry (HR people will have to learn to be calm amidst the storm). I told him I’ll get back to him and will ask him to sign a document.

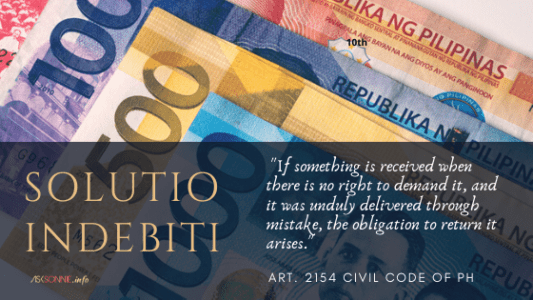

The solution is “Solutio indebiti“. It emanates from the concept of “unjust enrichment”. This has a basis in our Civil Law specifically,

SECTION 2 – Solutio Indebiti

Art. 2154. It states that, “If something is received when there is no right to demand it, and it was unduly delivered through mistake, the obligation to return it arises.”

It takes place when a person receives something from another without any right to demand for it, and the thing was unduly delivered to him through mistake. In the case of salary/wages unduly given to the employee, the employer is not barred from taking it back if there is truly a mistake. The only thing that will bar the employer from taking it back is laches.

Laches is defined as the failure or neglect, for unreasonable and unexplained length of time, to do that which by exercising due diligence, could or should have been done earlier. The negligence or omission to assert a right within a reasonable time, warranting a presumption that the party entitled to assert it either has abandoned it or declined to assert it. (Tijam v Sibonghanoy, L‐21450, Apr. 15, 1968)

Editors note:

If an employee received the SBWS aid, but in the end, s/he is not entitled (received because of error), or disqualified because of resignation or just cause termination, employer can collect the money from employee.

One might say, “Won’t it infringe the concept of non-dimunition of benefits under the Labor Code?”

The answer? It will not. In order that the situation may fall under the non-diminution of benefits, said benefits have been enjoyed by the employee for quiet sometime already, it was voluntarily given by the management or is included in the CBA (otherwise it will fall under unfair labor practice) and it was arbitrarily taken away from the employee without any justifiable reason.

The correct salary/wage must be immediately given to the affected employee with a corresponding notice or letter informing the employee about it and the correction that was done.

What happens to the excess amount given?

The excess amount must be reimbursed by the employee and return it to the employer. A gratuitous employer may waive the excess amount, but doing so runs counter against the concept of solutio indebiti. After coming up with an acceptable and reasonable action I then drafted the letter. I informed my boss about “Solutio Indebiti“. He was relieved to have that issue resolved.

Do consult your In-house Counsel or Company Lawyer should you need more in depth legal in sight about this.

pano pag hindi alam ni employee na iba pala ung rate niya nung nilagay sya sa ibang position? tapos kinukuha nung employer ung mga sobra na sahod na nabigay last 2 months?

tama lang po yun

Hi! We have an employee nagkasalary increase and got promoted. However, yung increase na naibigay ko is mali yung rate. Instead of 35k nailagay ko is 40k and its been 5months na bago ko nakita yung error. May mavviolate po ba ako na rules if ever na bawiin yung overpaid salary and idecrease yung salary nya, iaalign na sa tama? Which is gagawin na 35k.

ang susundin po na rate is yung nasa contract, and after due process, pwede po bawiin yun.