In determining the amount of premium, you need to determine the basis of contribution / deductions as prescribed by the government agencies.

The guidelines are as follows:

- SSS Premium

- All actual remuneration for employment, including the mandated cost of living allowance. This means all regular and supplementary income receives by the employee

- PHIC (Philhealth) Premium

- Basic Monthly Compensation regularly paid for service rendered by the employee

- HDMF (Pag-ibig Fund) Premium

- Basic Monthly Salary plus mandated cost of living allowance (maximum of Php 5,000)

SSS Premiums

One of the government mandated statutory deduction is the Social Security Contribution. As an employer, you need to ensure that you are deducting and collecting the correct Employee share (EE share) in your employees’ salary and contributing the correct Employer share (ER share).

SSS provides benefits that employees can enjoy such as Retirement benefits, Disability benefits, Maternity benefits and Sickness benefits.

You may want to read:

SSS Contribution During Maternity Leave

SSS Sickness Benefit and Magna Carta for Women

SSS Sickness Benefit and Threatened Abortion

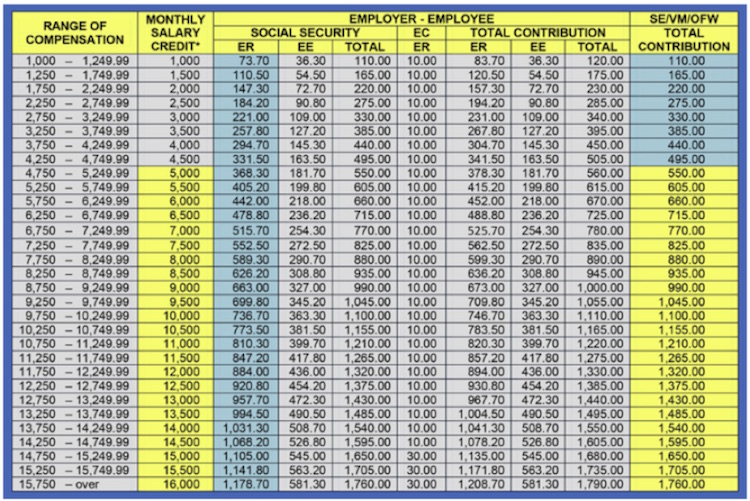

The total amount of an employee’s SSS contribution is computed as 11% of the monthly salary (not more than Php16,000), but this is actually shared between the employee and the employer – the employee shoulders 3.63% while the employer pays for the remaining 7.37%. The SSS uses a table to determine the amount that should be deducted from an employee based on his monthly income.

As an illustration, we will use the sample information below to determine how much is the EE and ER share.

- Basic Salary: Php 15,000.00

- Overtime Pay: Php 1,500.00

- Absences deduction: Php 2,350.00

- Late deduction: Php 1,000.00

- Monthly meal Allowance: Php 500.00

Using the information above, the total income of the employee is Php 13,650.00 (regular and supplementary). Now that we have the total income, we will determine the Salary Credit using the SSS table below:

The total earnings falls under the salary credit of Php 13,500.00. The total ER share is Php 1,004.50 (994.50 +10.00 EC) while the total EE share is Php 490.50.

*Reference: RA 8282 22 July 1998 – Social Security Act of 1997 (Strengthening the SSS Law – RA 1161).

PhilHealth (PHIC) Premium

Another important statutory deduction is the Philhealth contribution. Employer needs to ensure that they collecting and reporting the correct amount of premiums and reported it on time for the employees to avail of the benefits.

Some of the benefits a Philhealth member can avail are the In-patient and Out-patient coverage benefits and other packages such as Coverage up to the 4th normal spontaneous delivery, CBC and other laboratory test, etc.

An employee must have an updated contribution when they’re availing of their HMO benefits, otherwise, they will shoulder the bill for the Philhealth portion.

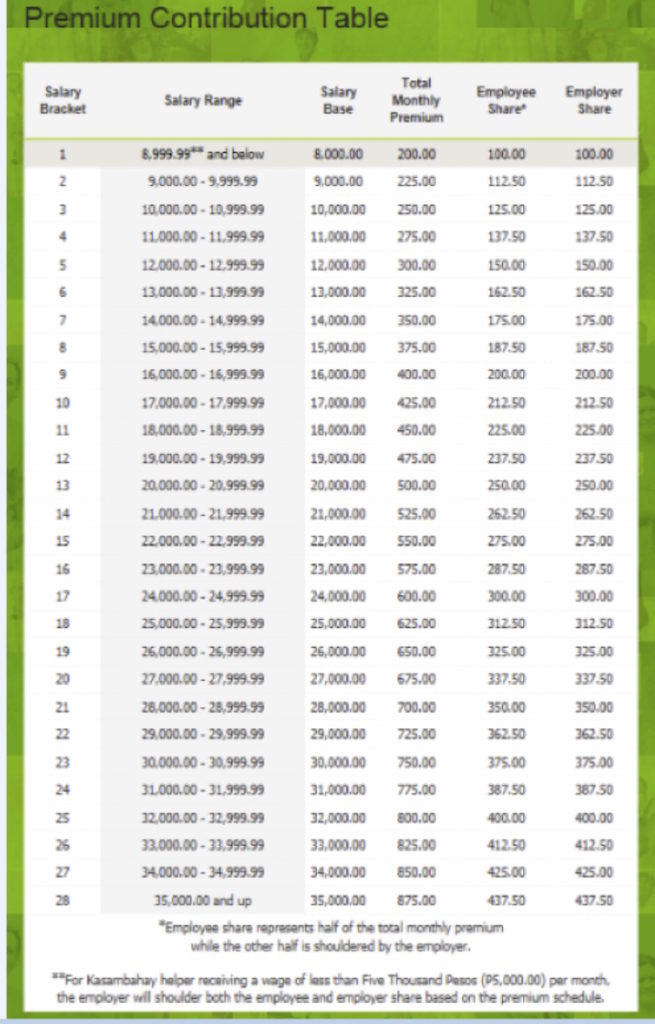

Using the same illustration we have earlier, we can determine the Employee and Employer share by looking on the table below:

The income of Php 13,650.00 falls under the salary bracket Php 13,000.00. The Employee share is Php 162.50 and the Employer share is also Php 162.50

*Reference: RA 7875 as amended by RA 9241, 25 July 1994 – national Health Insurance Act of 1995.

Pag-ibig (HDMF) Premium

The Home Development Mutual Fund (HDMF) or more popularly known as Pag-IBIG Fund, was created on June 11, 1978 by virtue of Presidential Decree 1530, later amended by Presidential Decree 1752 and Republic Act 7742. Pag-IBIG is an acronym which stands for Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industria at Gobyerno.

The Pag-IBIG Fund is created to provide socialized housing program for the Filipinos. Regular members can avail of the standard housing loan, multi-purpose loan and calamity loan. They can also claim for the mutual fund upon their retirement.

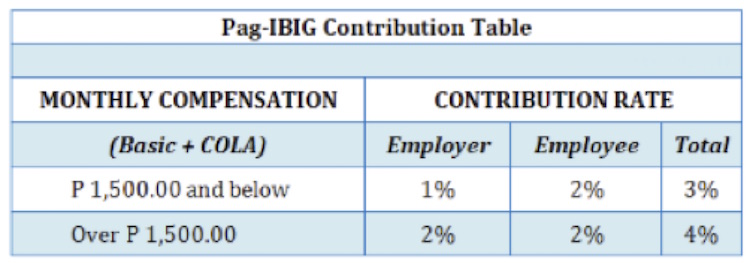

Below is the table for your reference:

The maximum monthly compensation to be used in computing employees and employer contributions shall not be more than Php 5,000.00. Provided, that this maximum maybe fixed from time to time by the Board of Trustees through rules and regulations adopted by it, taking into consideration actuarial calculations and rates of benefits.

Given the previous sample with total income of Php 13,650.00, the Employee share will be Php 100.00 and the Employer share is Php 100.00.

Note that employee may opt to increase their share to avail of higher benefits in the future.

*Reference: RA 9679, 28 July 2008 – Home Development Mutual Fund Law of 2009.

Discover more from ASKSonnie.INFO

Subscribe to get the latest posts sent to your email.

Hi! So meaning po ba pati yung de minimis kasali sa computation?

What if Income is P1000

HDMF would be – 50EE 100ER?